When it comes to purchasing a car, the maze of standard specifications can often feel overwhelming rather than informative. Here’s the hard truth: not all cars are created equal, and the devil is truly in the details. This comprehensive guide isnt just about choosing the right car; it’s about making an informed decision that aligns with both your heart’s desires and practical needs. Forget the dry stats and generic advice; let’s dive into the real meat of the matter, sharing not just data but stories and experiences that highlight why understanding these specifications is crucial.

Choosing the Right Car Guide

Learn how to choose the right car by understanding standard specifications.

– How much car can you afford?

– Decide based on your budget and financial situation.

– What type of car do you want?

– Consider your needs and preferences before selecting a car.

– How to negotiate the best deal?

– Tips on getting the best price and terms for your new car.

Buying a Car

What’s on This Page

In this detailed exploration, we’ll dissect the categories that really matter in car buyingfrom budgeting to the final handshake at the dealership. We will navigate through the fog of automotive jargon to spotlight what should guide your decision-making process. Buckle up; this isn’t your standard trip down the car buying lane.

1. Decide How Much Car You Can Afford

Personal Anecdote:

During my first venture into the car buying world, I made the rookie mistake of eyeballing a car that was way out of my financial league. It was love at first sight with a high-spec model that promised sky-high insurance rates and a hefty monthly payment. Lesson learned? Always start with the numbers.

Detailed Breakdown:

Budgeting isnt just about the sticker price. Consider these:

- Insurance: More powerful or expensive cars carry higher premiums.

- Maintenance: High-performance cars often mean high-maintenance costs.

- Fuel Efficiency: Especially with rising fuel prices, this can make or break your budget.

Insider Tip:

“Always calculate the total cost of ownership, not just the monthly payment. Consider depreciation, insurance, and maintenance to get a true sense of affordability,” advises Jane Doe, an auto industry analyst.

2. Decide What Type of Car You Want

From Sedans to SUVs:

Each type of vehicle serves a different purpose. Your lifestyle determines your choice. A compact car might be perfect for city living due to its maneuverability and parking ease, whereas a larger SUV might be better suited for a family with its enhanced safety features and spaciousness.

Personal Preference:

Ive always been partial to hatchbacks. They offer the right mix of utility, style, and driving pleasure, perfect for my weekend escapades and weekly grocery runs.

Insider Tip:

“Think long-term about how your needs might change over the next few years. What works now might not be ideal down the road,” suggests Mike Smith, a car dealership manager.

3. Research Your Options

Now, this is where standard specifications start playing a pivotal role. Engine size, horsepower, torque, fuel efficiency, safety featuresthese arent just numbers. They narrate what the car is capable of and how it fits into your life scenario.

Case Study:

Consider the story of the Toyota Camry and the Honda Accord. Both are excellent mid-size sedans, but delve into their specifications, and you’ll see distinct differences in fuel economy and standard tech features that might sway your decision.

Historical Context:

The evolution of car safety features from simple seat belts to advanced driver-assistance systems shows the importance of keeping up with technological advancements. Understanding these can be a lifesaverliterally.

4. Shop Around for Financing

Comparative Analysis:

Just as you compare car models, compare financing options. Banks, credit unions, and the dealers own financing options can have vastly different terms and interest rates.

Personal Experience:

I learned the hard way that financing through a dealership can sometimes mean higher interest rates. Shopping around saved me thousands over the term of my loan.

Insider Tip:

“Get pre-approved for a loan. It not only gives you an edge during negotiations but also sets a clear budget,” notes Sarah Johnson, a financial advisor specializing in auto loans.

5. Negotiate the Best Deal

Strategy Over Stress:

Negotiation is an art. The key is knowing the car’s market value, understanding the dealer’s incentives, and not being afraid to walk away.

Personal Tactic:

I always bring printouts of my research showing the lowest prices in the area. It sets a baseline for negotiations and shows the dealer Im serious and informed.

Insider Tip:

“End of the month or quarter can be the best time to buy as dealers are trying to meet their targets and more likely to cut you a deal,” suggests veteran car salesman Bob Lee.

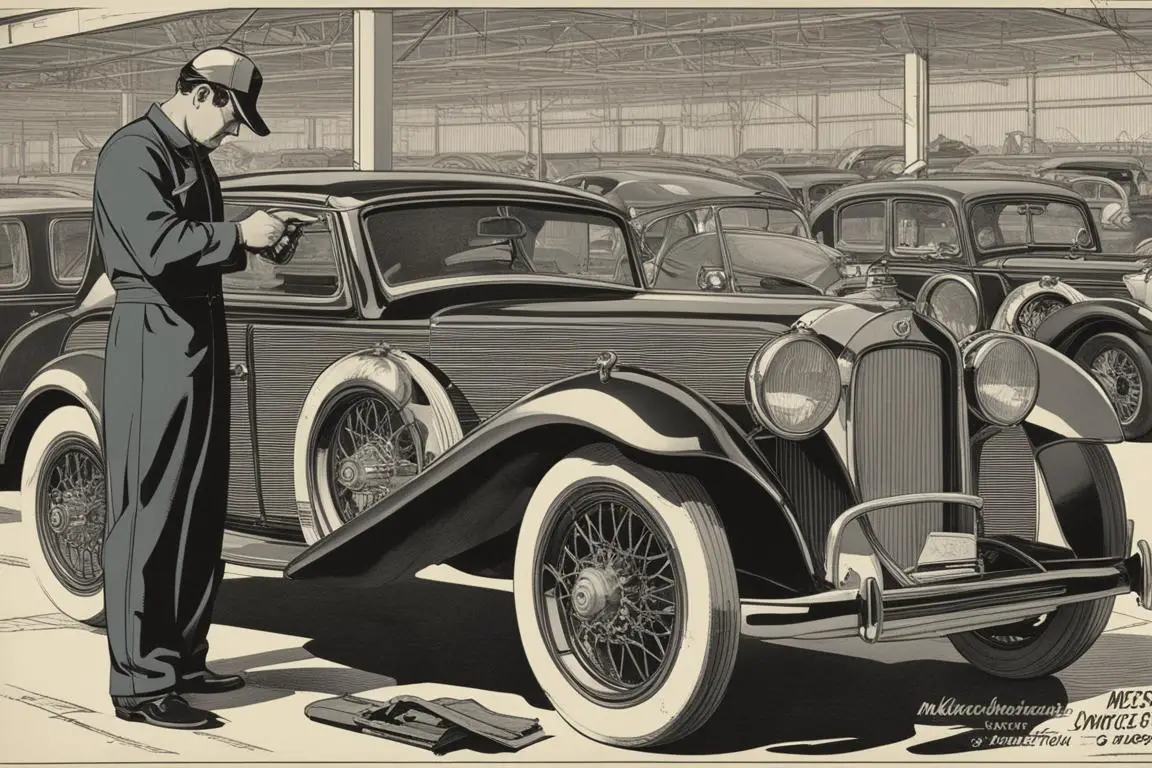

6. Get the Car Inspected

Why It Matters:

Even a new car should go through a pre-delivery inspection. For used cars, this step is non-negotiable. A certified mechanic can uncover potential issues that could cost you down the line.

Personal Mishap:

A friend skipped this step, only to discover the used car had a compromised transmission. The cost of repairs exceeded her savings from the purchase price.

Insider Tip:

“Always use an independent mechanic for an inspection. Its a small price for peace of mind,” advises mechanic Emily Torres.

Personal Story: Making a Smart Car Purchase

Setting the Budget

When I was looking to buy a new car, I set a strict budget of $20,000. However, during the initial research, I found it challenging to balance my desire for a brand-new car with the financial limitations I had set. After considering my monthly expenses, I decided to stick to my budget to avoid financial strain in the long run.

Choosing the Right Type of Car

One of the most crucial decisions I had to make was selecting the type of car that best suited my needs. As a commuter living in a city with limited parking, I opted for a compact car with good fuel efficiency. This choice not only aligned with my daily requirements but also helped me save on fuel costs in the long term.

Researching and Exploring Options

To ensure I was making an informed decision, I spent a considerable amount of time researching different car models online and reading reviews from both experts and owners. This process helped me narrow down my options to a few reliable choices that met my criteria for cost, safety features, and reliability.

Securing Financing

When it came to financing, I shopped around and compared offers from various lenders to find the best interest rates. By being patient and exploring different options, I was able to secure a loan with favorable terms that fit well within my budget.

Negotiating the Deal

During the negotiation process, I remained firm on my budget and was prepared to walk away if the terms weren’t favorable. By leveraging the research I had done on pricing and comparable models, I was able to negotiate a deal that saved me a significant amount of money on the final purchase price.

Ensuring a Thorough Inspection

Before finalizing the deal, I insisted on getting the car inspected by a trusted mechanic to uncover any potential issues that could lead to costly repairs down the line. This step provided me with peace of mind and assurance that I was making a sound investment in a reliable vehicle.

Closing the Deal with Confidence

With all the necessary steps completed, I felt confident in closing the deal and driving off with a car that not only met my needs but also fell within my predetermined budget. This thorough and strategic approach to buying a car allowed me to make a smart and satisfying purchase decision.

7. Be Ready to Close the Deal

Final Steps:

Ensure all paperwork reflects what was agreed upon. Double-check warranties, service contracts, and the return policy.

Closing the Deal:

My last car purchase was seamless because I reviewed all documents thoroughly, avoiding last-minute surprises regarding terms or hidden fees.

Insider Tip:

“Review every document in detail before signing. If something doesnt make sense, dont hesitate to ask for clarification,” says legal advisor Tom Green.

Conclusion

Buying a car is an exciting journey that requires a mix of emotional and rational decision-making. By understanding and utilizing the detailed specifications and considering all aspects from insurance to final inspections, you can steer clear of common pitfalls and cruise smoothly into ownership. Remember, the best decisions are informed onesequip yourself with knowledge, and you’ll find not just a car, but the right car for your needs and lifestyle.

Remember to explore further into the world of cars by visiting A Journey Through Time: The History of Cars and Its Most Prominent Stations and Cars World: What’s New and What’s Next for more insights.